- US stocks dive as Fed signals rate hikes to combat inflation. Global markets react to economic fears and geopolitical tensions.

- President Biden visits South Korea and Japan to reinforce US alliances in response to North Korea and China's rising influence.

- Gasoline prices are rising sharply, with projections hitting $5 and possibly $6.20 per gallon as supply tightens and inflation persists.

- The EU meeting in Brussels did not reach a consensus on new sanctions, including an oil embargo on Russia, due to Hungary's objections.

- Shanghai's full recovery from COVID-19 starts June 1. Export rates show signs of rebound amid improving conditions.

- The U.S. State Department initiates a program to capture evidence of Russian war crimes in Ukraine, ensuring accountability for atrocities.

- The Biden administration's new license allows Chevron to negotiate with Venezuela, signaling a shift in U.S. policy amid ongoing opposition talks.

- Guangxi Baise-1 limestone mine auctioned for 1.11 billion yuan, highlighting significant premium and future production plans.

- Airbus addresses titanium supply risks due to Russia sanctions, aims for A320 production boost by 2025.

- Shanghai outlines a phased return to normal life from June 1 after a lengthy Covid-19 lockdown, impacting the economy and global supply chains.

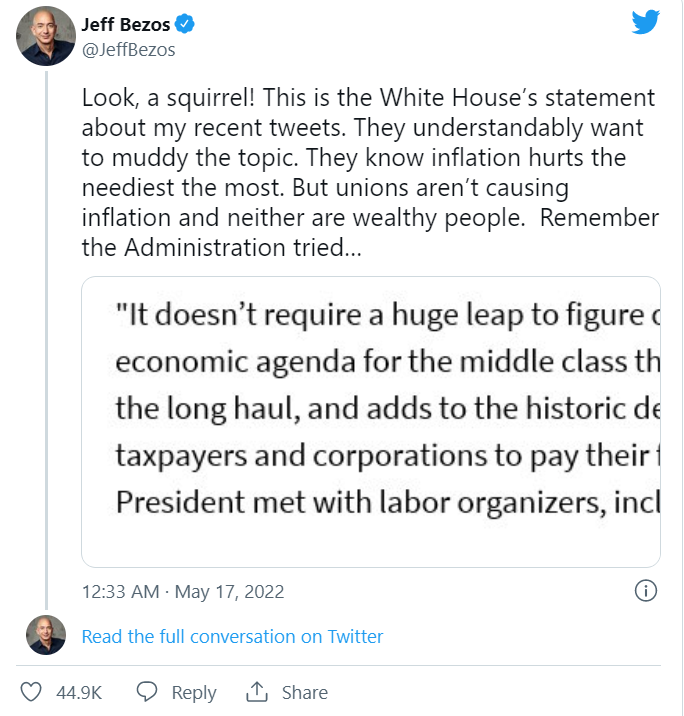

- Jeff Bezos accuses Biden of misdirection on inflation and taxes, sparking a war of words over corporate taxation and economic policy.

- BASF secures a 25-year renewable energy deal for its Zhanjiang base, marking a milestone in China's green energy market.

- Tianzhou-4 cargo ship successfully launched, opening China's Space Station with innovative coatings from Shanghai Institute of Siliconate.

- President Biden meets Southeast Asian leaders to unite against China while addressing trade and climate issues.

- Despite expected growth, construction material prices remain volatile and high in 2022 due to ongoing global issues.

- Mall

-

Titanium Industry Chain

Paints & Inks Industry Chain

Resin Industry Chain

- PVC Additives

- Heat Stabilizer

- Plasticizer

- Flame Retardant

- Foam Agent

- Lubricant

- Impact Modifier

- Pigment

- Light Stabilizer

- Antioxidant

- Processing Acids

- Filling Agent

Powders Industry Chain

Coal Chemicals Industry Chain

Solvent Industry Chain

Sands & Minerals Industry Chain

Medical Industry Chain

Others

-

- Preferred suppliers

- Warehouse Logistics

- Expo Services

- Industry-Finance

- About Us